November 01, 2019 • Press Releases

MIB Pushes for Increase Revenue with new Platform

Marathon Insurance Brokers has pumped over $100 million in a platform that allows consumers to compare offerings from multiple insurance companies.

It’s the latest initiative geared at improving earnings for the 25-year-old company, which is also planning an initial public offering next March.

The application, called MIBinsure, is the product of a five-year process and seeks to fill the needs of the Jamaican consumers in the private motor vehicle space.

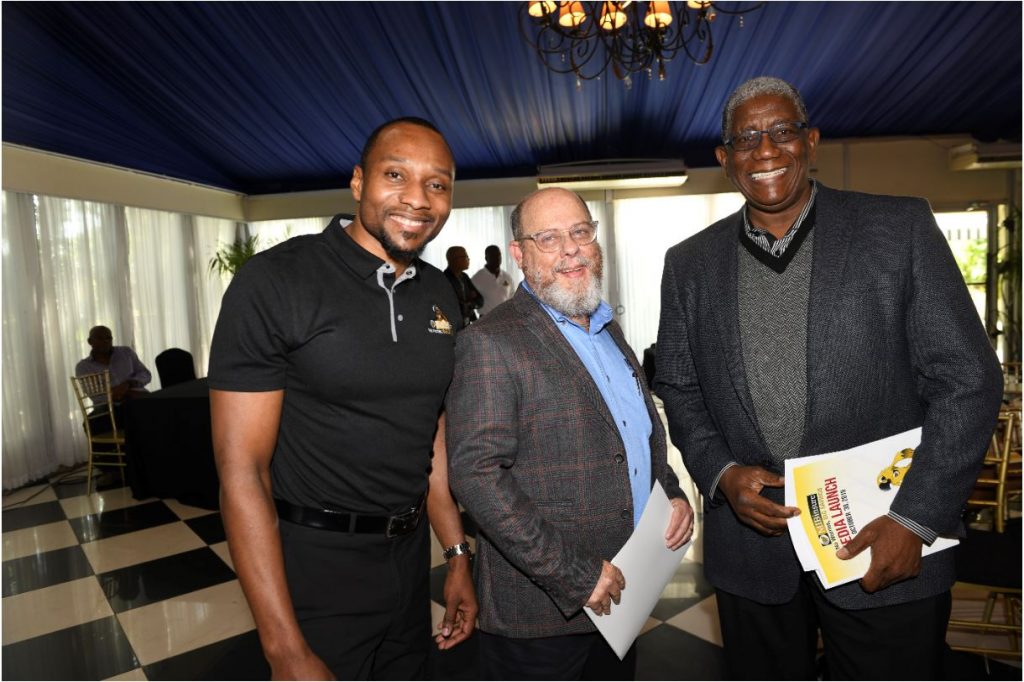

Chairman of Marathon Insurance Brokers (MIB), Richard Burgher is adamant that the application, which he says is a first in the island, will provide consumers with better pricing, more choices along with the convenience of doing business online.

Insurers are also expected to benefit from the platform through wider market access, greater efficiency and the ability to readily see how well their products stand up to the competition.

“Although Jamaica’s insurance industry has had compound annual growth rate of approximately seven per cent over the past ten years, the way business is conducted has remained relatively the same for decades,” Burgher said.

“There is no existing medium that allows the Jamaican consumer to compare and choose insurance coverage from every insurer that is willing to provide you with a quote on your motor cars or motorcycle,” he continued.

Marathon Insurance claims the title of one of the largest insurance brokers in Jamaica. The company currently provides a wide range of insurance coverage including cyber risks, business interruption, professional indemnity, money, motor, yacht and pleasure craft, renewable energy and property.

Through MIBinsure, Marathon Insurance has partnered with all 11 insurance providers across the island and will serve as an intermediary between the consumer and the insurance companies.

Once the insurance premium is selected, consumers will have the option to pay the sum upfront, or benefit from a nine-month loan from Marathon Insurance.

MIBinsure today allows consumers to insure motor vehicles online, access cover notes and invoices.

The with planned IPO, Burgher hopes to fund the development of a platform that will allow customers to renew policy online, report claims and get claims settled online come next year.

“Typically settling your claim in this country takes maybe up to 60 days, we are trying to get a claim settled in less than five days,” he said.

The capital raise, which is targeted for listing on the junior market of the Jamaica Stock Exchange will also be partly used to fund Marathon’s venture into financing clients for insurance premiums.

With branches in Kingston; Montego Bay, St James; Savanna-La-Mar, Westmoreland and Portmore, St Catherine; Marathon Insurance experience in insurance spans major sectors such as industrial, agriculture, financial services, manufacturing, mining, transportation and distribution, among others.